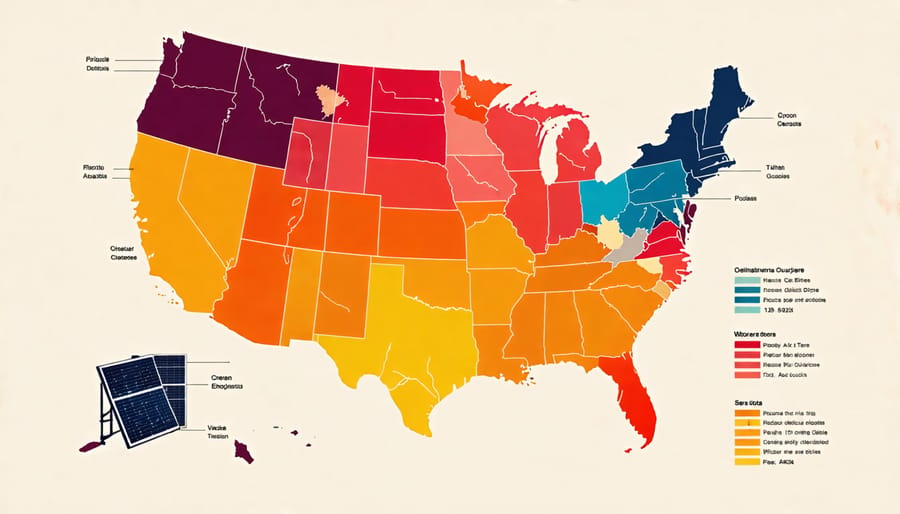

Harness the power of the sun and save big on your energy bills with solar panel incentives tailored to your state. From generous federal tax credits to state-specific rebates and grants, there’s never been a better time to make the switch to solar. Solar advancements have made it more affordable and accessible than ever before. Discover the array of incentives available to you, whether it’s net metering policies that credit you for excess energy produced or solar renewable energy certificates that put cash back in your pocket. With the right combination of incentives, you could slash your upfront costs by up to 50% and enjoy substantial long-term savings on your electricity bills. Don’t miss out on this opportunity to go green and keep more green in your wallet – explore the solar panel incentives in your state today and take the first step towards a brighter, more sustainable future.

Federal Solar Incentives

The federal government offers several incentives to encourage the adoption of solar energy. The most significant of these is the Solar Investment Tax Credit (ITC), which allows homeowners to claim a federal tax credit for a percentage of the cost of their solar panel system. As of 2023, the ITC stands at 30% of the total system cost, providing substantial savings for those who invest in solar. This credit applies to both residential and commercial installations, making it an attractive option for homeowners and businesses alike.

In addition to the ITC, there are other federal programs designed to make solar more accessible. For example, the U.S. Department of Energy offers solar energy grants through its Solar Energy Technologies Office. These grants support research, development, and deployment projects that aim to reduce the cost of solar and improve its performance. While these grants are typically awarded to organizations rather than individuals, they contribute to the overall growth and affordability of the solar industry.

Another federal initiative is the Residential Renewable Energy Tax Credit, which allows homeowners to claim a credit for a portion of the cost of solar water heating systems, fuel cells, and small wind turbines. This credit is separate from the ITC and has different eligibility requirements and credit amounts.

It’s important to note that federal solar incentives are subject to change based on legislation and budgetary considerations. Homeowners interested in taking advantage of these programs should stay informed about the latest developments and consult with a tax professional to ensure they are claiming the credits correctly.

State Solar Incentives

California

California leads the nation in solar energy adoption, thanks in large part to its generous incentives for homeowners who install solar panels. The state offers a variety of programs designed to make going solar more affordable and accessible. One of the most significant incentives is the Solar Investment Tax Credit (ITC), which allows homeowners to claim a credit of 26% of the cost of their solar system on their federal taxes. This credit is available through 2022 and will step down to 22% in 2023 before expiring in 2024 unless Congress renews it.

In addition to the federal ITC, California also has its own California’s solar tax incentives that can save homeowners even more money. The state’s Self-Generation Incentive Program (SGIP) provides rebates for the installation of solar battery storage systems, which can help homeowners maximize their energy savings by storing excess solar power for use during peak demand hours or power outages.

California also has a net metering policy that allows homeowners to sell excess solar energy back to the grid at retail rates, essentially spinning their electric meters backwards and reducing their utility bills. With these incentives in place, it’s no wonder that California has become a leader in residential solar adoption, with over one million solar roofs installed to date.

Texas

Texas offers a combination of state and local incentives to encourage solar adoption. While there is no statewide solar tax credit, many utilities provide rebates and incentives for installing solar panels. For example, Austin Energy offers a rebate of $2,500 for customers who install solar, while CPS Energy in San Antonio provides rebates of up to $1.20/watt. Additionally, Texas has a statewide property tax exemption for the added value of solar panels, ensuring that installing solar doesn’t increase your property taxes.

Net metering is available in some areas of Texas, allowing solar owners to send excess electricity back to the grid for credit. However, policies vary by utility, so it’s essential to check with your local provider. Furthermore, Texas has a renewable energy credit trading program that requires utilities to generate a portion of their electricity from renewable sources, indirectly supporting the growth of solar.

While Texas may not have the most extensive statewide incentives, the combination of utility rebates, property tax exemptions, and the federal solar tax credit still makes going solar an attractive financial proposition for many Texans. As solar costs continue to fall and more Texans recognize the benefits, the Lone Star State is poised for significant solar growth in the coming years.

Florida

Florida, the Sunshine State, offers a range of solar incentives to encourage homeowners to switch to clean energy. While there is no statewide solar tax credit, Florida does offer property tax exemptions for residential renewable energy property, meaning installing solar panels won’t increase your property taxes. Additionally, Florida’s net metering policy allows homeowners to sell excess solar energy back to the grid at retail rates, helping offset electricity costs.

Some utility companies in Florida provide rebates and incentives for solar installations. For example, Jacksonville Electric Authority (JEA) offers a Solar Battery Incentive Program, providing rebates for solar battery storage systems. It’s worth checking with your local utility to see what programs are available.

Although Florida doesn’t have a dedicated state-funded solar rebate program, many municipalities and counties offer localized incentives. The Broward Solar Co-op in Broward County and the Orlando Solar Co-op are examples of regional initiatives that make going solar more affordable through group purchasing power.

By combining these incentives, Floridians can significantly reduce the upfront cost of solar installations and enjoy long-term energy savings. With abundant sunshine and a supportive policy landscape, Florida is an excellent state for homeowners looking to make the switch to solar power.

New York

New York offers a variety of solar incentives and rebates to make going solar more affordable and accessible for homeowners. The NY-Sun Megawatt Block Incentive provides direct incentives for solar electric systems, with rates varying based on system size and location. Homeowners can also take advantage of the Solar Energy System Equipment Credit, which offers a 25% state tax credit up to $5,000 for the cost of solar panel installation.

Net metering allows homeowners to sell excess solar energy back to the grid, earning credits on their utility bills. The New York State Energy Research and Development Authority (NYSERDA) offers low-interest loans through the Green Jobs – Green New York program to help finance solar installations. Additionally, many local governments and utility companies provide property tax exemptions and rebates for solar energy systems.

By combining these incentives with the federal solar tax credit, which currently stands at 26%, New York homeowners can significantly reduce the upfront cost of going solar. With abundant sunshine and a commitment to renewable energy, New York is an excellent place for homeowners to invest in solar panels and enjoy long-term savings on their energy bills while contributing to a cleaner environment.

Other Notable States

While some states offer more robust solar incentives than others, many have implemented programs to encourage solar adoption. For example, New Jersey provides a generous solar renewable energy certificate (SREC) program, allowing homeowners to earn credits for the electricity their solar panels generate. These credits can then be sold for additional income. Maryland also offers SRECs, along with a state solar tax credit of up to $1,000. In the southwest, Arizona and Nevada both provide strong net metering policies, ensuring homeowners receive fair credit for the excess energy their solar panels send back to the grid. Additionally, Texas has a property tax exemption for the added value of solar installations, helping to offset initial costs. While these states may not have the most comprehensive incentives, they demonstrate the growing commitment to solar energy across the country. As more states recognize the benefits of solar power, homeowners can expect to see an increasing array of financial incentives designed to make going solar more accessible and affordable.

How to Claim Solar Incentives

Claiming solar incentives is a straightforward process when working with a reputable solar installer. Here’s a step-by-step guide to help you navigate the process:

1. Research available incentives: Look into federal, state, and local incentives for which you may qualify. Your solar installer can help identify these opportunities.

2. Get a solar quote: Contact a local solar installer for a personalized quote based on your energy needs and property. They’ll design a system that maximizes your savings and incentives.

3. Apply for incentives: Your installer will assist you in filling out the necessary paperwork for federal, state, and local incentives. They’ll ensure you have the required documentation.

4. Schedule installation: Once your incentive applications are submitted, your installer will schedule a time to install your solar panels. The process typically takes 1-3 days.

5. Final inspections: After installation, your system will undergo final inspections from the city and utility company. Your installer will handle this process.

6. Start saving: Once your system is approved, it will be connected to the grid. You’ll start generating clean energy and seeing savings on your electricity bills. Plus, you’ll receive your incentive payments according to each program’s timeline.

By working with an experienced solar installer, you can ensure a smooth process for claiming incentives and maximizing your solar savings. They’ll be your guide every step of the way, from initial quote to final installation and beyond.

Conclusion

In conclusion, solar incentives offer homeowners an incredible opportunity to save money on their energy bills while making a positive impact on the environment. By taking advantage of federal tax credits, state rebates, and net metering programs, the upfront cost of installing solar panels can be greatly reduced, leading to long-term financial benefits. As we’ve seen, the benefits of residential solar extend beyond just the monetary savings – embracing clean energy helps reduce our carbon footprint and contributes to a more sustainable future. With so many compelling reasons to go solar, it’s worth exploring how these incentives can make solar power an affordable and eco-friendly choice for your home. Take the first step today and discover how solar can work for you.