As energy costs continue to surge and environmental concerns take center stage, residential solar panels have emerged as a compelling solution for modern homeowners. This innovative technology offers the potential for significant energy savings and environmental benefits, but it also comes with important considerations that every homeowner should carefully evaluate. From substantial electricity bill reductions and increased property values to initial installation costs and maintenance requirements, understanding the complete picture of solar panel ownership is crucial for making an informed decision. Whether you’re motivated by financial savings, environmental impact, or energy independence, exploring the advantages and limitations of residential solar systems will help you determine if this renewable energy investment aligns with your household’s goals and circumstances.

The above introduction balances the optimistic tone with practical considerations, avoids technical jargon, and sets up the reader for a detailed exploration of solar panel benefits and challenges. It speaks directly to homeowners’ interests while maintaining an approachable, informative style that builds credibility and engagement.

Understanding Solar Panel Insurance Coverage

Homeowners Insurance and Solar Panels

Good news for solar panel owners: most standard homeowners insurance policies include coverage for rooftop solar installations. These systems are typically considered a permanent attachment to your home, similar to a deck or built-in appliances. Understanding the impact on homeowners insurance is straightforward – your existing policy should protect against common risks like storm damage, fire, and theft.

However, it’s essential to notify your insurance provider when installing solar panels, as you may need to adjust your coverage limits to reflect the increased value of your home. Most insurers will simply update your policy without significant premium increases, though rates may vary by provider and location.

Some insurance companies even offer special discounts for homes with solar installations, recognizing their contribution to sustainability and grid independence. To ensure complete protection, review your policy details and confirm that both the panels and related equipment are fully covered under your existing plan. If you’re financing or leasing your solar system, check whether additional coverage is required by your agreement.

Specialized Solar Insurance Options

When investing in solar panels, protecting your investment with specialized solar insurance is crucial. Many standard homeowners’ insurance policies offer basic coverage for solar installations, but dedicated solar panel insurance provides comprehensive protection tailored to your system’s specific needs.

These specialized policies typically cover damage from severe weather events, equipment malfunction, theft, and even power production losses. Some insurers offer performance guarantees, ensuring you’re compensated if your system doesn’t generate the promised amount of electricity.

Key benefits of specialized solar insurance include coverage for:

– Physical damage from hail, wind, and falling objects

– Electrical system failures and inverter issues

– Loss of income from reduced energy production

– Professional repair and replacement services

– Theft and vandalism protection

While these policies may cost slightly more than standard coverage, they often prove worthwhile considering the significant investment solar panels represent. Many providers offer flexible payment options and bundle discounts when combining solar insurance with existing home coverage.

Before selecting a policy, compare different providers’ offerings and ensure you understand coverage limits and deductibles. Some insurers also provide additional benefits like regular maintenance inspections and performance monitoring services.

Benefits of Solar Panel Insurance

Protection Against Natural Disasters

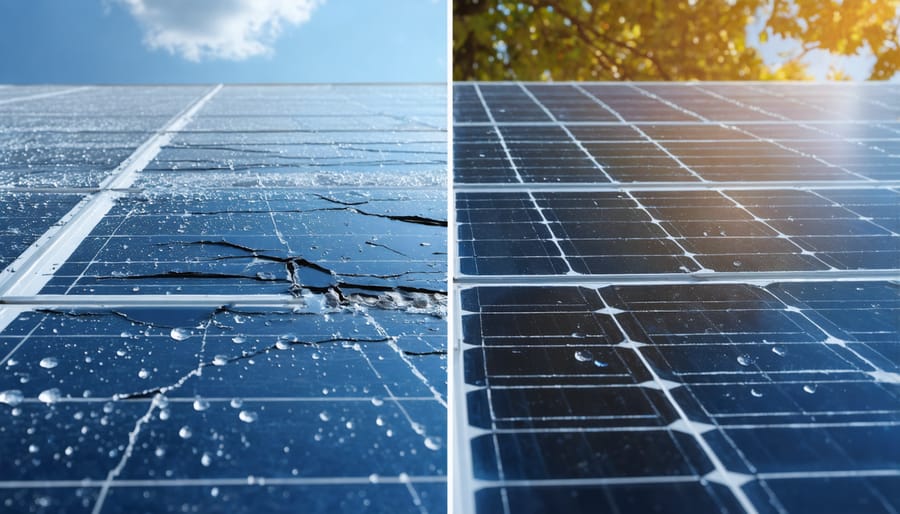

Solar panels are remarkably resilient when it comes to withstanding natural disasters and severe weather conditions. Most modern solar installations are designed to endure winds up to 140 mph, equivalent to Category 4 hurricane forces. Quality panels undergo rigorous testing and are built with tempered glass that can withstand substantial impacts from hail and falling debris.

During severe storms, properly installed solar panels can actually provide additional protection for your roof. They act as a shield, preventing direct impact from hail and reducing wear from heavy rain. In many cases, homes with solar installations have reported less roof damage following major storms compared to homes without panels.

Most homeowners insurance policies cover solar panels as part of your home’s structure, protecting against damage from natural disasters like hurricanes, tornadoes, and earthquakes. However, it’s essential to verify coverage specifics with your insurance provider and ensure your policy limits adequately reflect the added value of your solar system.

To maximize protection, work with certified installers who follow local building codes and use mounting systems designed for your region’s specific weather challenges. Regular maintenance and inspections can also help identify potential vulnerabilities before severe weather strikes. Remember that while no system is completely immune to extreme natural events, solar panels have proven to be remarkably durable and reliable even in challenging weather conditions.

Equipment Malfunction Coverage

When investing in solar panels, protecting your equipment against malfunctions and performance issues is crucial for long-term peace of mind. Most reputable solar panel manufacturers offer warranties ranging from 20 to 25 years, covering both equipment defects and performance guarantees. These warranties typically ensure that your panels will maintain at least 80% of their original power output over the warranty period.

However, manufacturer warranties may not cover all potential issues. That’s where equipment malfunction coverage through your homeowner’s insurance or specialized solar panel insurance comes in. This additional protection can safeguard against damage from severe weather, accidents, or unexpected technical failures not covered by the manufacturer’s warranty.

Many insurance providers now offer specific solar panel coverage as an add-on to existing homeowner’s policies. These plans typically cover:

– Physical damage to panels and mounting equipment

– Electrical component failures

– Inverter malfunctions

– Power output issues

– Labor costs for repairs

Before installation, it’s recommended to contact your insurance provider to understand your coverage options. Some companies may automatically include solar panels under your existing policy, while others require additional coverage. The cost of this protection is usually minimal compared to the value of your solar investment and the potential repair or replacement expenses it guards against.

Keep in mind that regular maintenance and professional inspections can help prevent equipment malfunctions and may be required to maintain your coverage validity.

Potential Insurance Challenges

Cost Considerations

The initial investment in residential solar panels typically ranges from $15,000 to $25,000 for a standard system, though prices can vary significantly based on your location, home size, and energy needs. While this upfront cost may seem substantial, several financial incentives help offset the expense. The federal solar tax credit allows you to deduct 30% of your installation costs from your federal taxes, and many states offer additional tax benefits and rebates.

Financing options make solar more accessible, with solar loans, leases, and power purchase agreements (PPAs) available. Solar loans typically offer interest rates between 3-8%, with terms ranging from 5-20 years. Monthly payments often align with or fall below current electricity bills, making the transition budget-friendly for many homeowners.

The return on investment typically occurs within 5-10 years, depending on your local electricity rates and solar production. Most homeowners see monthly electricity savings of $100-200, which can add up to significant long-term savings. Additionally, solar panels typically increase property values by 4-6%, offering another financial benefit.

Maintenance costs are relatively minimal, with annual inspections costing $150-300. The main components, such as inverters, may need replacement after 10-15 years, costing approximately $1,000-2,000. However, most solar panels come with 25-year warranties, protecting your investment for decades.

Coverage Limitations

While residential solar panels are typically covered under standard homeowners insurance policies, it’s important to understand certain limitations. Most insurance providers have specific coverage limits for solar systems, which may not fully protect your investment in all scenarios.

Common exclusions often include damage from normal wear and tear, manufacturer defects, or gradual deterioration. Many policies also don’t cover problems arising from improper installation or maintenance, which emphasizes the importance of working with certified installers and following manufacturer guidelines.

Ground-mounted solar panels might require additional coverage, as they’re sometimes considered separate structures from your home. Similarly, if you participate in a solar lease program, you’ll need to verify whether the leasing company provides insurance coverage or if you’re responsible for securing additional protection.

Weather-related limitations can vary by region. While most policies cover damage from storms and falling objects, some may exclude specific natural disasters like earthquakes or floods. It’s worth noting that production shortfalls due to weather conditions or seasonal changes typically aren’t covered by insurance.

To ensure comprehensive protection, consider reviewing your policy details with your insurance provider and discussing options for additional coverage where needed. Many insurers offer endorsements or riders specifically designed to fill these coverage gaps.

Making the Right Insurance Choice

When protecting your solar panel investment, understanding insurance considerations for solar panels is crucial. Start by reviewing your existing homeowners insurance policy, as many providers automatically cover solar installations. However, you may need to increase your coverage limits to fully protect your investment.

Consider adding specific solar panel coverage if your standard policy doesn’t provide adequate protection. Look for policies that cover damage from extreme weather, theft, and mechanical failures. Many insurers offer specialized renewable energy equipment coverage at reasonable rates.

Don’t forget to document your installation with photos and keep all paperwork, including warranties and maintenance records. This documentation will prove invaluable if you need to file a claim. Compare quotes from multiple insurance providers, and ask about discounts for safety features or professional installations.

Remember to update your policy whenever you upgrade your system or add new components. Most importantly, ensure your chosen coverage aligns with your local climate risks and system value to provide peace of mind for years to come.

Solar panels represent a significant but worthwhile investment for homeowners looking to embrace sustainable living and reduce their energy costs. While the initial installation costs can be substantial, the long-term benefits of reduced utility bills, increased property value, and environmental impact make them an attractive option for many households. The availability of tax incentives and financing options helps offset upfront expenses, making solar more accessible than ever.

Consider your specific circumstances, including roof condition, local climate, and energy needs, before making a decision. For most homeowners, the pros of solar installation – including energy independence, environmental benefits, and long-term savings – outweigh the potential drawbacks. With proper research, professional installation, and regular maintenance, solar panels can provide reliable, clean energy for decades while contributing to a more sustainable future.

We recommend consulting with multiple certified solar installers to get detailed quotes and exploring available incentives in your area before making your final decision.